Credit Bureau Complaints Blast Off in 2023

Consumer complaints against major credit bureaus surge by 550 percent from 2020-2023. CFPB criticizes their handling of issues. Stay vigilant about your credit reports

A storm has been gathering in the shadowed chambers of credit bureaus, where numbers whisper the tales of financial fates.

A recent surge in consumer complaints against the titans of credit reporting—TransUnion, Equifax, and Experian—has unearthed a groundswell of discontent.

Editors note. We asked ChatGPT to write that introduction in the style of Michael Monroe Lewis —the fellow who wrote Moneyball and the Big Short. While we are not sure the AI nailed Lewis's style, we liked what it generated enough to keep it, even if it reads too dramatic for our topic.

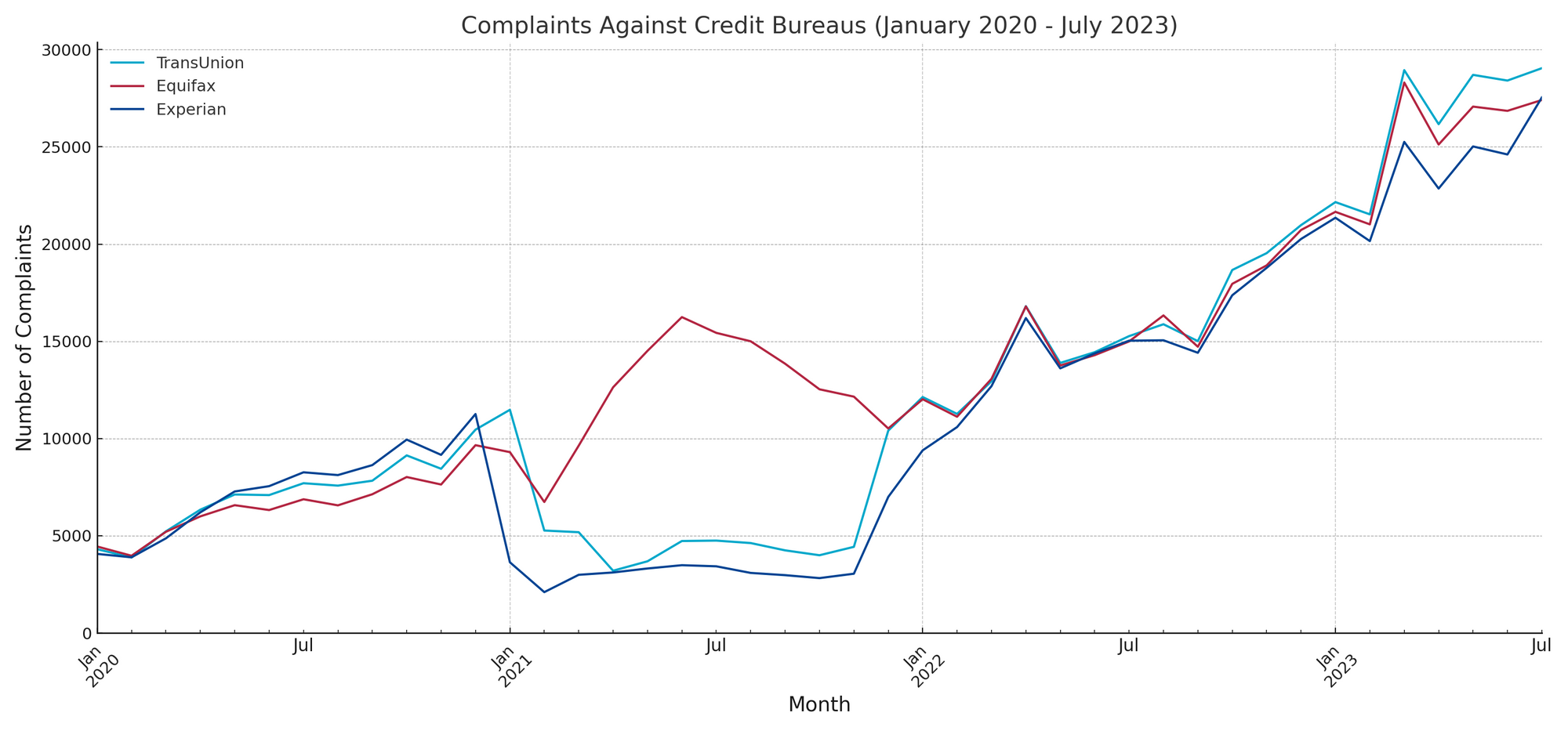

Between January 2020 and July 2023, the number of consumer complaints about the big three credit bureaus increased by more than 550 percent, according to the U.S. Consumer Financial Protection Bureau (CFPB).

All the way back in January 2022, CFPB Director Rohit Chopra said, "America's credit reporting oligopoly has little incentive to treat consumers fairly when their credit reports have errors."

What's more, things don't seem to be slowing down. In July 2023, there were almost 16,000 more complaints aimed at credit bureaus than in June.

Here is the trouble, about 18 months ago —at the time of writing— the CFPB called out the credit bureaus for not doing a good job handling complaints. Here is a quote from the CFPB's report.

"Equifax most often promised to open investigations and send the results to the consumers at later dates, but it would fail to provide the CFPB with the outcomes of the investigations.

"TransUnion made similar promises and frequently failed to provide the outcomes of investigations to the CFPB. It often stated it would take no action on complaints because it believed the complaints were submitted by third parties.

"For many complaints, Experian frequently stated it would take no action because it believed the complaints were submitted by third parties, however, it did respond to the remaining complaints with substantive responses."

In our opinion, this current surge is more reason for you to stay on top of your own credit reports, ensuring that information about your debts are accurate.

The underlying currents of discontent against credit bureaus underscore the importance of financial literacy and vigilance. As consumers, it's crucial to not only be aware of our credit standing but to also understand the mechanisms and potential discrepancies behind these numbers. Regularly reviewing credit reports, challenging inaccuracies, and being proactive in financial management can serve as protective barriers in a system that seems increasingly turbulent.