Driving into Debt. Auto Loan Interest on the Rise in 2023

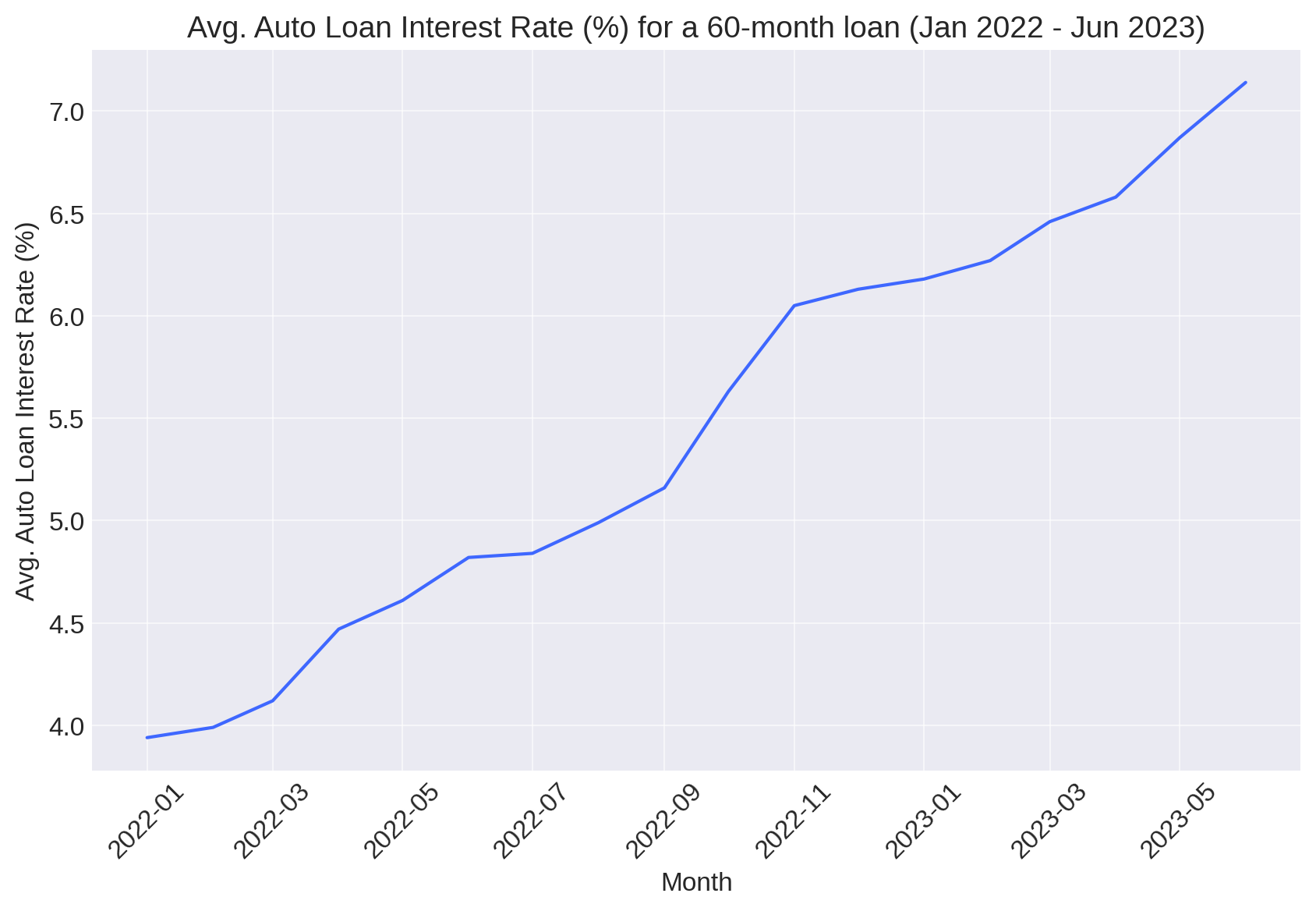

Halfway through 2023, the average interest rate charged for a 60-month, new-vehicle loan continues to rise in the United States.

After a mortgage and student loans, financing an automobile can be one of the most excessive things we do, and it is only becoming costlier.

Between January 2022 and June 2023, the average automobile loan interest rate for a 60-month, new-vehicle loan has risen from 3.94 percent to 7.14 percent in the United States, according to Bankrate.com and Statista.

| Month | Avg. Auto Loan Interest rate in % for a 60-month loan. |

|---|---|

| Jan 2022 | 3.94 |

| Feb 2022 | 3.99 |

| Mar 2022 | 4.12 |

| Apr 2022 | 4.47 |

| May 2022 | 4.61 |

| Jun 2022 | 4.82 |

| Jul 2022 | 4.84 |

| Aug 2022 | 4.99 |

| Sep 2022 | 5.16 |

| Oct 2022 | 5.63 |

| Nov 2022 | 6.05 |

| Dec 2022 | 6.13 |

| Jan 2023 | 6.18 |

| Feb 2023 | 6.27 |

| Mar 2023 | 6.46 |

| Apr 2023 | 6.58 |

| May 2023 | 6.87 |

| Jun 2023 | 7.14 |

Booming Interest

So let's put that in perspective.

In 2023, a typical auto loan is $40,000. Auto loans almost always use an amortization schedule so that interest is calculated (daily in most cases) based on the current balance owed.

If you had taken out a $40,000 loan in January 2022 at 3.94 percent and paid all 60 of the monthly payments, the total amount of interest paid would be $4,135. But that loan, taken out in June 2023, would cost $7,682 in interest.

| Month | Loan Amount | Loan Term | Interest Rate | Total Interest |

|---|---|---|---|---|

| January 2022 | $40,000 | 60 Months | 3.94% | $4,135 |

| June 2023 | $40,000 | 60 Months | 7.14% | $7,682 |

Auto Loan Implications

The extra $3,547 in interest might sound small to the millionaires in our readership, but for many Americans, this is a load of extra money that is not going to investments, starting a business, or getting a side hustle off of the ground, so to speak.

It is the opportunity cost that hurts.