Embrace the Laffer Curve for Everyone's Benefit

The Laffer Curve predicts that some tax increases can result in relatively less tax revenue whilst stifling the national economy.

An economic fact as old as the social science itself points out the strong relationship between tax rates, national revenue, and a better standard of living for everyone.

On a personal level, we are each trying to do our best with the resources available. We make decisions about where to work, how much to save, and what to buy. Those financial choices are ours, and we need to each take responsibility for them, but those choices are not made in isolation.

The economic environment informs those choices, and to whatever degree we can influence that economic environment, we should. So I suggest that we both remember and embrace the so-called Laffer Curve for our own benefit and, frankly, everyone's benefit.

Economics & Prices

Let's start with a couple of ideas.

First, economics is the study of how scarce resources, which have many and various possible uses, are allocated.

If you have a large water bottle, you can drink the water, dampen your face with the water on a hot day, wash your hands with some of it, or extinguish a campfire with it. You may pick one option or a combination of them, but when the bottle is empty, it's empty. You cannot do everything, and you cannot use more water than you have.

Second, prices are an indication of how best to use scarce resources which have alternative possible uses.

When the price of a widget rises in a market economy, we know that we collectively need more of that thing. If the price of bread goes up, it encourages bakers to bake more and other folks to become bakers. More bread being made will lead to more wheat production and so forth. The increase in price tells us there is more demand than supply for that given item. It helps us make efficient choices about resource allocation.

So prices are not something companies arbitrarily set; rather, they are a function of demand and supply in the marketplace. This is how things work, typically, in a market economy.

Higher Prices Don't Mean More Revenue

We are getting closer to how this impacts your personal bank balance but bear with me a little longer. I want to make another point about prices.

There is such a thing as the proper price for a given product. That price is the amount at which someone is willing to buy and at which the producer is willing to sell.

The producer will always be happy to raise the price of an item if raising that price increases profit, but raising prices does not always increase the total return on investment.

Imagine a company called "Frosty Delights" that sells vegan, oat milk ice cream cones. They currently sell each ice cream cone for $3 and have average daily sales of 1,000 cones, resulting in daily revenue of $3,000.

Frosty Delights decides to increase the price of each cone to $5, hoping to generate more revenue. However, after raising the price, they notice that their average daily sales have dropped to 500 cones. This results in daily revenue of $2,500, which is less than the previous daily revenue of $3,000.

In this example, Frosty Delights experiences a decrease in revenue after raising the price of their ice cream cones, similar to the Laffer Curve concept. The company has moved beyond the optimal price point, where the balance between the price and the number of customers purchasing the product maximizes revenue. This is not a perfect example because we don't know anything about Frosty Delights' costs, but let's play along for the purpose of illustration.

The Laffer Curve

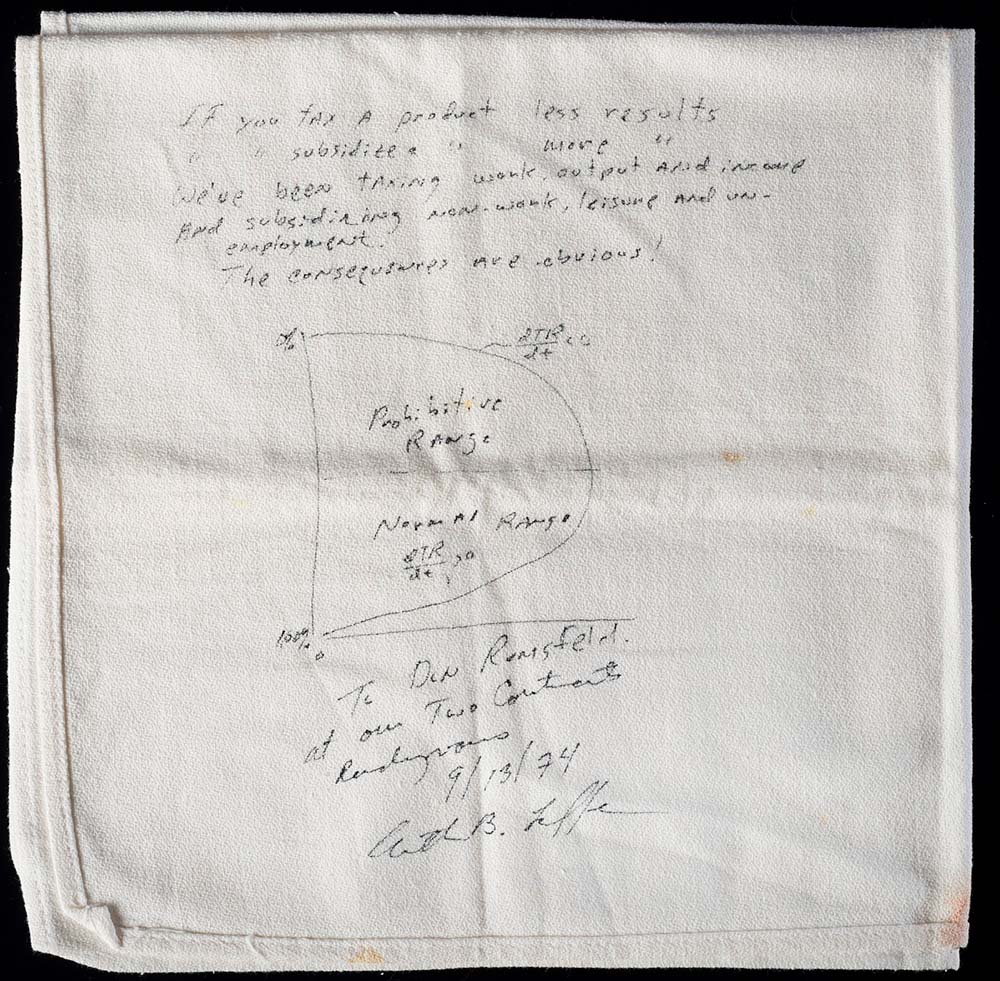

In September 1974, economist Arthur Laffer drew a curve on a napkin for Donald Rumsfeld when the latter was working for President Ford. It was a simple idea, if a government raises taxes too high, the tax increase will reduce tax revenue. The tax charged discourages production and stifles growth. To use the common vernacular, the juice is not worth the squeeze.

In a sense, when a government raises taxes beyond the optimal tax point, it does the same thing Frosty Delights did in the example above. It puts the price (tax) so high that it gets fewer customers and less tax revenue.

Thus, the Laffer Curve demonstrates the relationship between tax rates and tax revenue, suggesting that there is an optimal tax rate that maximizes revenue. This concept has influenced tax reforms worldwide, with proponents arguing that lowering taxes can sometimes lead to increased revenue and economic growth.

The Laffer Curve played a significant role in shaping U.S. tax policy during the 1980s, particularly during the presidency of Ronald Reagan. Proponents of the Laffer Curve, such as Laffer himself and political commentator Jude Wanniski, argued that high tax rates were stifling economic growth and that cutting taxes would stimulate the economy.

Reagan's administration implemented several tax cuts, most notably the Economic Recovery Tax Act of 1981, significantly reducing income tax rates.

The U.S. economy experienced strong growth during the 1980s; as a result. This period became known as the "Reagan Revolution," and the Laffer Curve was central to its economic philosophy.

Laffer Led to Prosperity

Let's paraphrase Laffer and think about how taxes impact us.

Imagine you are a real estate investor. You build a new apartment building. It is just about to open, and the government raises taxes from 10 percent to 90 percent. It is likely that you will not stop operating. Rather, you will open the building, market it, and try to get renters. But you might maintain it differently than you would have when you got to keep 90 percent of the profit. Now, you might do just enough to get by.

The converse is also true. If the government lowers the tax rate from 90 percent to 10 percent, you cannot just conjure another apartment building, rather, it takes years to get the project going.

The point here is that the long era of relatively lower corporate tax rates in the United States that started with President Reagan and continued right up until 2023 may have fueled a long period of economic growth and stability.

If you live and work in a low-tax economic environment, you will be encouraged to work more, innovate more, and ultimately build more wealth.

The personal finance decisions you make have a positive and outsized impact.

Taxes Might Rise Again

Circa April 2023, there are discussions about raising corporate and individual taxes in the United States. The premise for these tax hikes is that we need more revenue for government programs.

Specifically, President Biden's 2024 federal budget proposal seeks $4.7 trillion in tax increases on businesses and individuals, making the U.S. tax rates some of the highest in the developed world.

All of this makes me wonder if we have forgotten the Laffer Curve and what it represents.