How Do I Get a Copy of My Credit Reports?

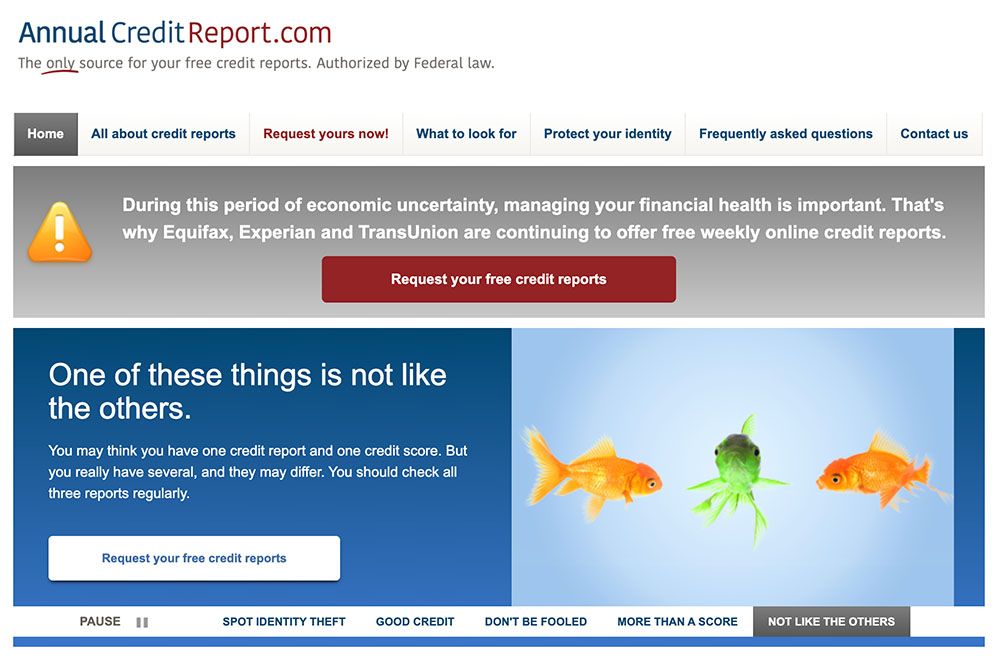

In the United States, you can get a free credit report each year. Simply visit AnnualCreditReport.com.

Credit reports play a significant role in your personal finances, affecting numerous aspects of your life.

These reports are a comprehensive record of our credit history, and they help lenders, landlords, employers, and others make important decisions about our financial reliability.

A good credit report can make it easier to secure loans at lower interest rates, rent an apartment, or even land a job. Understanding and monitoring your credit report will help you proactively maintain a healthy credit score and improve your overall financial well-being.

In the United States, three major credit bureaus are responsible for collecting and maintaining credit information: Equifax, Experian, and TransUnion.

These independent agencies gather data from various sources, such as banks, credit card companies, and public records, to create an accurate and up-to-date credit report for each individual. Each bureau may have slightly different information, so it's important to review your credit reports from all three agencies to ensure accuracy and comprehensiveness. In the following sections, we'll discuss how to obtain your credit reports and what to look for when reviewing them.

So how do you get a copy of your credit report?

In the United States, you can get a free credit report each year. Simply visit AnnualCreditReport.com.

What is a Credit Report?

A credit report is a detailed document that provides a snapshot of an individual's credit history, summarizing how they have managed credit and debt over time. It is an important tool for lenders, landlords, employers, and others to assess a person's creditworthiness and financial responsibility.

Credit Report Components

A typical credit report consists of four main sections: personal information, credit accounts, inquiries, and public records.

Personal information

This section includes identifying information such as your name, current and previous addresses, Social Security number, date of birth, and employment history. This data helps credit bureaus and lenders confirm your identity when accessing your credit report.

Credit Accounts

The credit accounts section is a comprehensive record of your credit history, including details about your credit cards, mortgages, student loans, auto loans, and other lines of credit. For each account, the report typically lists the account type, credit limit or loan amount, outstanding balance, payment history, and the date the account was opened or closed.

Inquiries

Inquiries on your credit report represent instances when a lender, landlord, or other party has requested access to your credit information. There are two types of inquiries: hard and soft. Hard inquiries occur when you apply for credit, such as a mortgage or credit card, and can have a minor, temporary impact on your credit score. Soft inquiries, which include pre-approved credit offers or your own requests for your credit report, do not affect your credit score.

Public Records

The public records section of your credit report contains information about any financial or legal issues that may impact your creditworthiness, such as bankruptcies, tax liens, or civil judgments. These records can have a significant adverse effect on your credit score and remain on your credit report for an extended period, typically seven to ten years, depending on the type of record.

Credit Report vs. Credit Score

A credit report and a credit score are closely related but distinct aspects of an individual's credit profile.

A credit report is a comprehensive document that provides a detailed overview of a person's credit history, including personal information, credit accounts, inquiries, and public records. It serves as a record of how an individual has managed credit and debt over time.

On the other hand, a credit score is a numerical representation of a person's creditworthiness derived from the information in their credit report. Credit scores are calculated using various scoring models, with the most common being the FICO and VantageScore models.

In essence, the credit report provides the raw data, while the credit score offers a quick snapshot of a person's credit risk, which lenders and other entities use to make financial decisions.

Credit Bureaus Have a Role Too

There are major credit bureaus in the United States. These bureaus administer the credit reports.

Equifax

Equifax is one of the three major credit bureaus in the United States, with a history dating back to 1899. As a credit reporting agency, it gathers and maintains financial data on millions of consumers, helping lenders and other entities assess credit risk. Equifax provides credit reports and scores, identity theft protection services, and other financial products for consumers and businesses alike.

Experian

Experian, founded in 1968, is another leading credit bureau that collects and analyzes credit information on individuals in the United States and worldwide. In addition to providing credit reports and scores, Experian offers credit monitoring, fraud detection, and various financial tools for both consumers and businesses.

TransUnion

Established in 1968, TransUnion is the third major credit bureau in the United States. Like Equifax and Experian, TransUnion collects and maintains credit information on millions of consumers, generating credit reports and scores that help lenders and other entities make informed decisions. TransUnion also offers credit monitoring, fraud protection, and other financial services for consumers and businesses.

Differences and Similarities Among the Credit Bureaus

While the three major credit bureaus—Equifax, Experian, and TransUnion—all serve the same basic purpose of collecting and maintaining credit information, there are some differences in the way they operate. Each bureau may have slightly different data sources or use different scoring models, which can lead to minor variations in the information contained in your credit reports.

However, despite these differences, the credit bureaus have many similarities. They all gather information on your credit history, including account details, payment history, and public records. Additionally, each bureau must follow the same regulations under the Fair Credit Reporting Act (FCRA) to ensure accuracy, privacy, and fairness in the credit reporting process.

Obtain Reports From All Three Bureaus

Because each credit bureau may have slightly different information or use different scoring models, obtaining and reviewing credit reports from all three bureaus is crucial.

Errors or discrepancies in one report may not appear in the others, which could affect your credit score and overall creditworthiness. By reviewing reports from all three bureaus, you can ensure the accuracy of your credit information and identify any potential errors or signs of fraud that need to be addressed.

If you identify an error on your credit report, it's essential to take action to have it corrected. The U.S. Consumer Financial Protection Bureau (CFPB) recommends disputing the error with a credit-reporting company such as Experian, Equifax, or TransUnion.

In the article "How Do I Dispute an Error on My Credit Report?" we describe the step-by-step process needed to remove errors from your credit report.

How to Get a Free Credit Report

As mentioned above, AnnualCreditReport.com is the only authorized website for free credit reports under U.S. federal law.

Once you have accessed AnnualCreditReport.com, follow the prompts to request your credit reports. You can request reports from one, two, or all three credit bureaus.

Since you can get three reports, effectively, it may be a good idea to stagger your requests throughout the year to monitor your credit more frequently. Fill out the required information, including your name, address, Social Security number, and date of birth.

Information Needed to Verify Your Identity

To protect your privacy and ensure the security of your personal information, the credit bureaus may ask you to verify your identity by answering a series of questions related to your credit history. These questions could include information about your previous addresses, loan amounts, or other account details. Answer the questions accurately to access your credit report.

The Fair Credit Reporting Act and Free Credit Reports

The FCRA is a federal law that regulates the credit reporting industry and promotes the accuracy, fairness, and privacy of information in credit reports. Under the FCRA, you are entitled to one free credit report every 12 months from each of the three major credit bureaus. AnnualCreditReport.com was established to help consumers exercise this right.

Other Situations May Entitle You to a Free Credit Report

In addition to the annual free credit report, you may be entitled to additional free credit reports under certain circumstances:

- Identity theft — If you are a victim of identity theft or have reason to believe that your personal information has been compromised, you can request a free credit report to monitor your credit and detect any fraudulent activity.

- Unemployment — If you are unemployed and plan to seek employment within the next 60 days, you may request a free credit report to ensure that your credit information is accurate and up-to-date.

- Denied credit or employment — If you have been denied credit, insurance, or employment due to information in your credit report, you can request a free copy of the report from the credit bureau that provided the information within 60 days of the adverse action.

- Receiving public assistance — If you are currently receiving public assistance, such as welfare or food stamps, you are eligible for a free credit report to help you manage your financial situation and work toward self-sufficiency.

How to purchase Additional Credit Reports

If you've already accessed your free annual credit reports and need additional copies or want to monitor your credit more frequently, several options are available.

Directly From Credit Bureaus

You can purchase credit reports directly from each of the three major credit bureaus—Equifax, Experian, and TransUnion—through their respective websites. This is a straightforward way to obtain your credit report and ensures that you access the most up-to-date information directly from the source. Just be careful. The bureaus may try to upsell you credit monitoring services which can be rather expensive.

Third-party Services

Several third-party services provide access to your credit reports from one or more credit bureaus.

These services may offer additional features like identity theft protection, fraud alerts, or credit score monitoring. Before choosing a third-party service, research the company and read reviews to ensure they are reputable and trustworthy.

Also, check prices. Some of them are costly.

Subscription-based Services and Credit Monitoring

Many credit bureaus and third-party companies offer subscription-based services that provide ongoing access to your credit reports and scores, as well as credit monitoring and alerts.

These services can help you closely monitor your credit, identify any changes or potential fraud, and provide guidance on improving your credit score. Some subscription-based services also include identity theft protection and assistance if your personal information is compromised.

These services are often free with your credit cards, so you might be able to get this information easily.

Prices and Comparison of Services

To reiterate, the cost of purchasing additional credit reports or subscribing to credit monitoring services can vary widely depending on the provider and the features offered. When comparing services, consider factors such as the frequency of credit report updates, the inclusion of credit scores, and the availability of additional tools and resources to help you manage and improve your credit.

Before purchasing a credit report or signing up for a subscription-based service, read the terms and conditions, understand the fees involved, and verify that the service meets your needs and budget.

Remember that you are entitled to one free credit report from each credit bureau every 12 months through AnnualCreditReport.com, so be sure to take advantage of this resource before considering additional purchases.

Reviewing Your Credit Report

Once you have obtained your credit report, it's essential to review the information carefully for accuracy. Ensure that your personal information, such as your name, address, and Social Security number, is correct. Review your credit accounts to verify that the balances, payment history, and account status are accurate and up-to-date.

While reviewing your credit reports, you may encounter errors or discrepancies that could negatively impact your credit score. Common errors include incorrect account information, duplicate accounts, outdated information, or fraudulent activity.

If you identify any errors, it's important to dispute them promptly. You can do this by contacting the credit bureau that provided the report and providing documentation to support your claim. The bureau is required to investigate your dispute, typically within 30 days, and correct any inaccuracies.

Regularly reviewing your credit reports allows you to monitor your credit history and track changes in your credit score. By staying informed about your credit, you can identify areas that need improvement and take steps to maintain or enhance your creditworthiness. Monitoring your credit also helps you detect signs of identity theft or fraud, enabling you to take swift action to protect your financial well-being.

Consider setting reminders to request your free annual credit reports or sign up for a credit monitoring service to receive regular updates and alerts about changes to your credit profile. By proactively managing your credit, you can improve your financial stability and access better opportunities for loans, credit cards, and other financial products.

Your Credit Report

Regularly reviewing your credit reports is critical to managing your finances. By staying informed about your credit history and identifying any errors or discrepancies, you can ensure the accuracy of your credit information and safeguard your credit score. Monitoring your credit also allows you to detect any signs of identity theft or fraud, helping you protect your financial well-being and prevent long-term damage to your credit.

Credit Health

To maintain good credit health, consider taking the following steps:

- Make timely payments — Pay all of your bills on time, as payment history is a significant factor in your credit score. Setting up automatic payments or reminders can help avoid late or missed payments.

- Keep credit utilization low — Aim to use no more than 30% of your available credit at any given time, as high credit utilization can negatively impact your credit score.

- Limit hard inquiries — Be mindful of applying for new credit, as multiple hard inquiries can temporarily lower your credit score. Only apply for credit when necessary and research the approval requirements beforehand to increase your chances of success.

- Diversify your credit mix — Having a variety of credit types, such as credit cards, auto loans, and mortgages, can positively affect your credit score. However, only take on new credit if you can manage it responsibly.

- Monitor your credit reports — Regularly review your credit reports from all three major credit bureaus to ensure accuracy, identify errors, and monitor changes in your credit history.

By following these steps and proactively managing your credit, you can improve your financial stability and secure better opportunities for loans, credit cards, and other financial products in the future.