The 4% Rule of Retirement

The four-percent rule suggests that you should never run out of money in your retirement portfolio. The balance will fluctuate with the market, but there would always be a substantial sum.

The idea is that when you retire, you only withdraw four percent of your total portfolio balance each year.

If you have a million dollars in year one, you take $40,000. If the next year you have $990,000, you would only withdraw $39,600. Some years you will have more. Some years you will have less.

There is also a version of this rule wherein you withdraw the initial four percent each year. So $40,000 each year, if you started with a $1 million balance. This second version is better for budgeting, but slightly less of a guaranteed outcome.

Again, the four-percent rule suggests that you should never run out of money in your retirement portfolio. The balance will fluctuate with the market, but there would always be a substantial sum.

Assumptions

The four-percent rule, also, comes with a couple of assumptions.

First, there is an asset allocation assumption. It is the idea that your investment risk makes sense relative to your age.

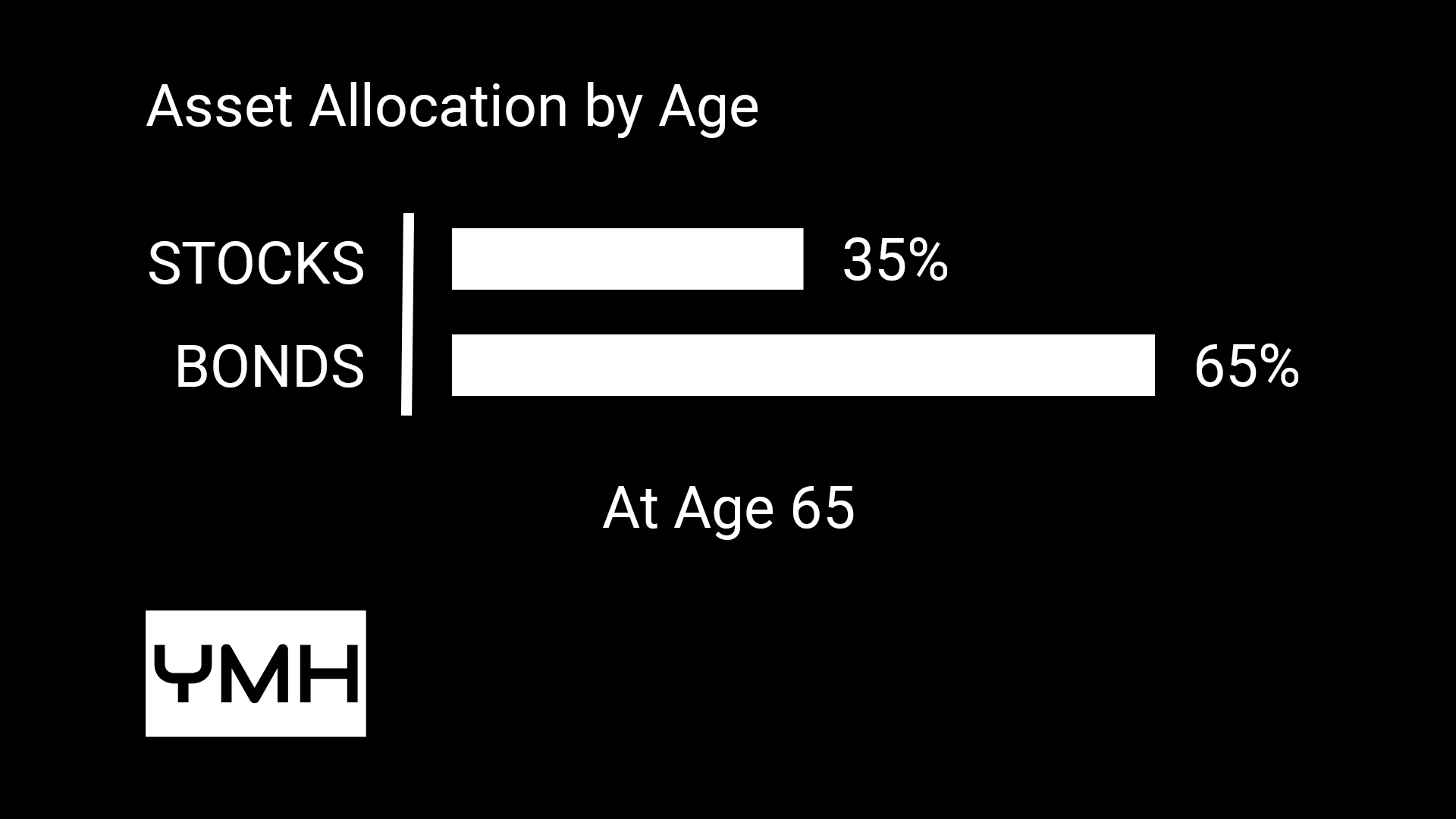

Some experts say your age in years should equal the percentage of your investments in bonds versus stocks. So a 65-year-old starting to retire should have about 65 percent of his investments in bonds.

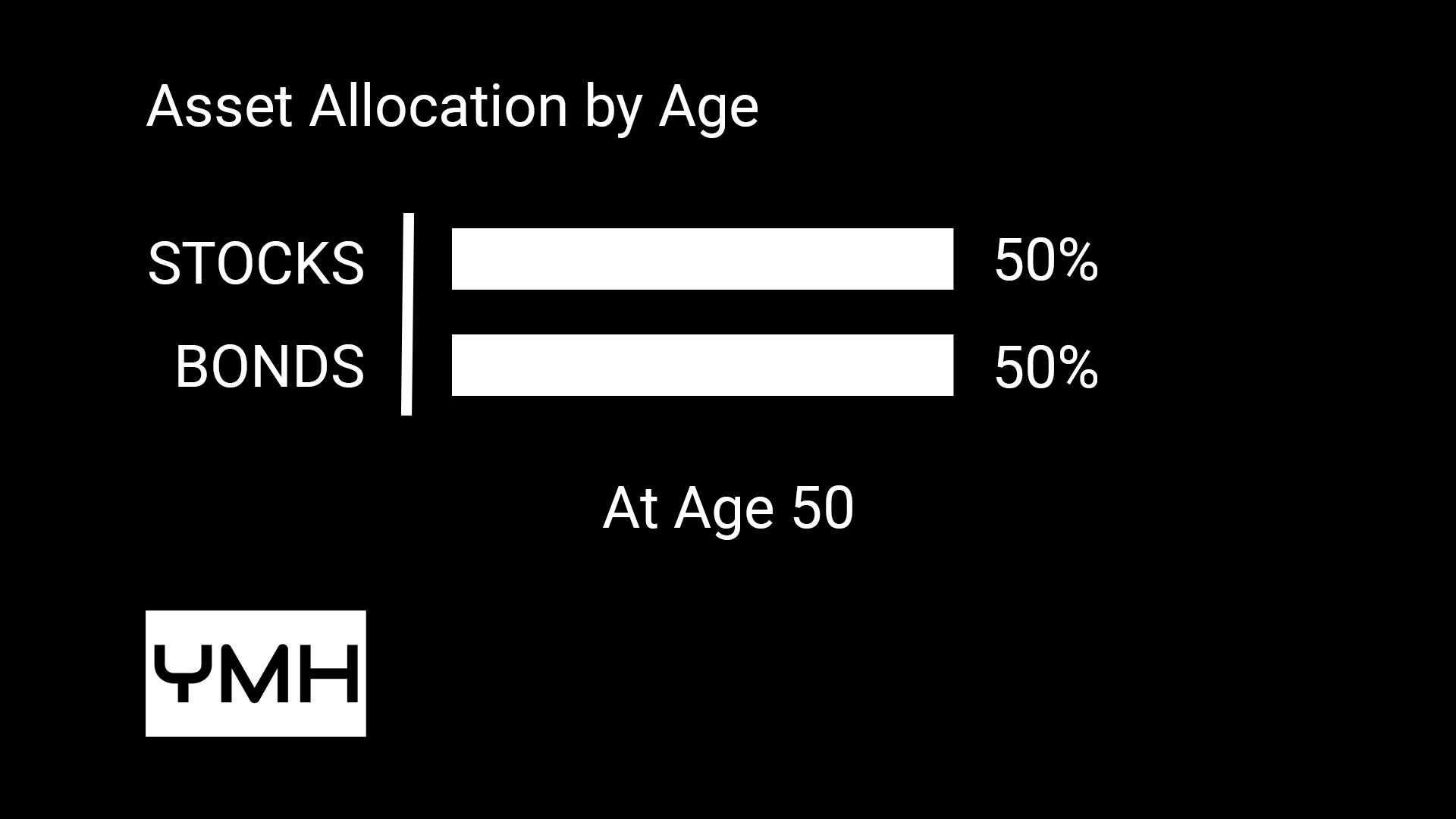

If you are 50, you should have about 50 percent of your retirement portfolio invested in bonds and the other half in stocks.

Some experts recommend freezing this asset allocation ratio at age 65, others keep the age-to-bond relationship going longer.

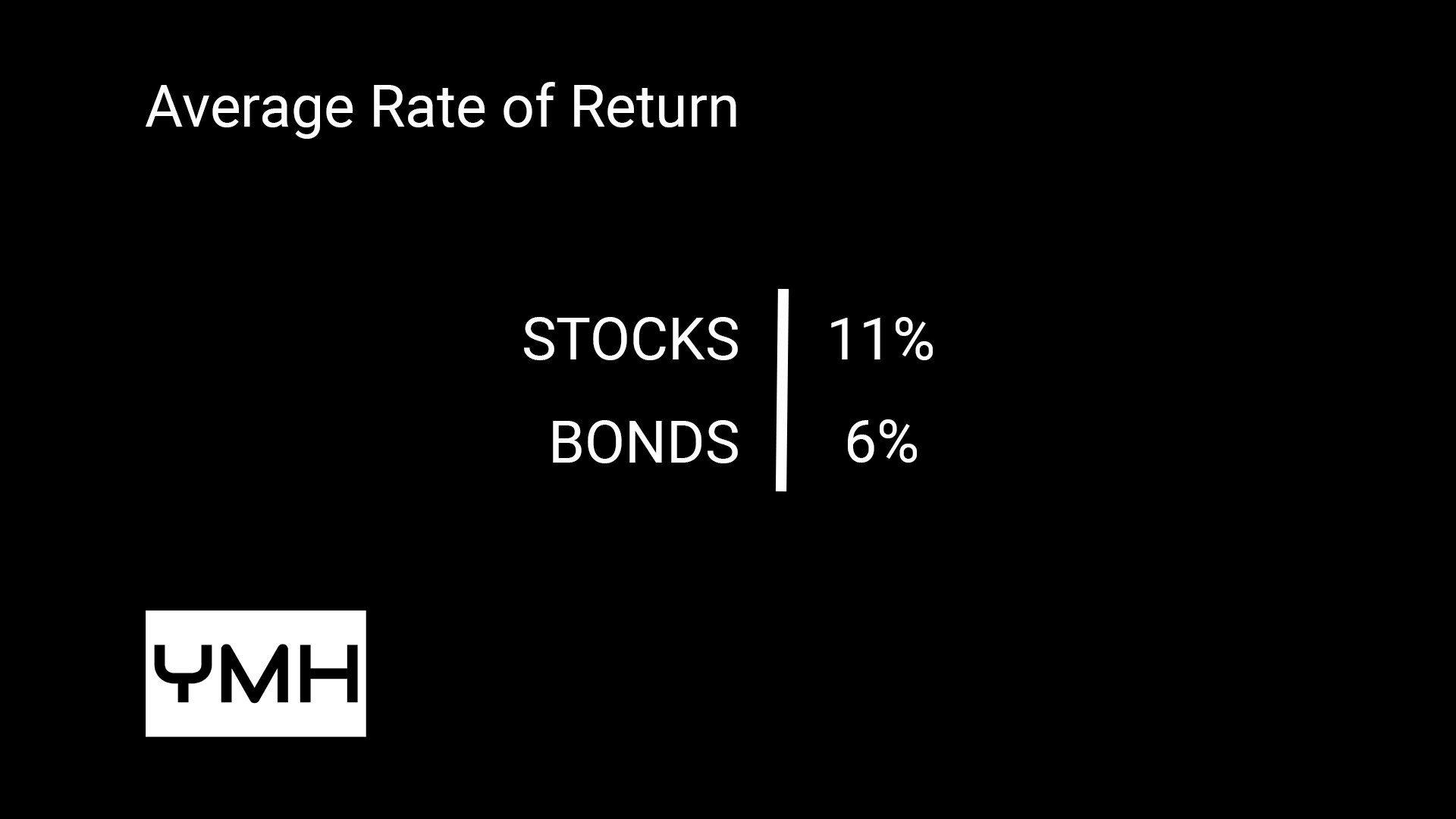

Second, the four-percent rule assumes that you will earn an average return on stocks of about 11 percent and an average return on bonds of about six percent over time.

Finally, the four-percent rule is a heuristic, a rule of thumb. And there are times when it will not work out. So you want to make sure you are paying attention to your portfolio balance and adjusting as needed.

How Much do You Need to Retire

If the four-percent rule is to be effective for you, it means that you have to have a large enough retirement portfolio to live on just four percent of it. Thus, you are going to need 25 times your annual expenses in retirement.

If you expect your annual expenses to be $100,000, you need a retirement portfolio of about $2.5 million for the four-percent rule to work.

So that is the four-percent retirement rule in a nutshell.

Resources

If you would like to learn more about the 4% rule of retirement, here is a list of resources in no particular order.

- What Is The 4% Rule For Retirement Withdrawals? from Forbes,

- Beyond the 4% Rule: How Much Can You Spend in Retirement? via Charles Schwab,

- What Is the 4% Rule for Withdrawals in Retirement and How Much Can You Spend? from Investopedia,

- What Is the 4% Rule? in The Motley Fool,

- The 4% Rule Can Help You to Gradually Spend Your Retirement Savings, from U.S. News & World Report,

- The 4% Rule Gets a Closer Look, in Kiplinger,

- Fueling the FIRE movement: Updating the 4% Rule for Early Retirees, from Vanguard.